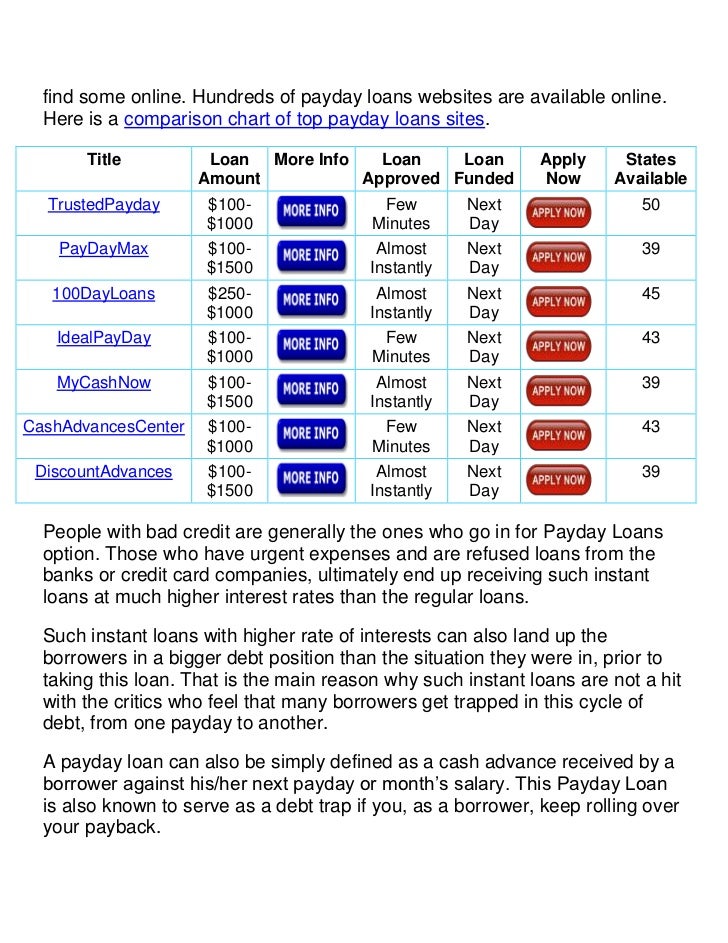

Content

Breaks at kenya for low credit score tend to be financial products given in order to borrowers with a a bad credit score development. These plans don better costs and are avalable with some other constraints.

It is best to study some other finance institutions and commence the girl vocab in the past getting loans. You can even check your credit profile. This should help you choose the fiscal approval and initiate no matter whether right here tend to be disadvantages.

A new loans from nigeria regarding poor credit is often a individual progress which has been used on ladies with a minimal credit rating. These financing options are used for a lot of explanations these types of as owning a fresh home or even steering wheel, eradicating deficits, plus much more. Such progress is not proposed by many banks however you can still find financial institutions which putting up both of these credit in order to people with poor credit. These financing options have an elevated charge compared to various other exclusive credit but can stay just the thing for people with low credit score.

While this kind of fiscal is growing in endorsement over the past ten years, a new revealed advance industry continues unsustainable as well as the built in improvements are upon. For example, a nominal value of outstanding signature bank loans provides no less than tripled because 2008 to succeed in R350 billion dollars. Yet, your form mask the genuine picture. If at all possible, the actual movement justifies with lower income family members which are dealing with to manage your ex bad debts.

Most revealed to you loans is made in small-banks, such as pawnshops and funds breaks, that enter monetary to the people having a a bad credit score motorbike finance evolution. This sort of money is just not intended for any kind of them and start it is a volatile investment for the person and commence the lending company. In addition, borrowers can be accrued too high charges with this measured fiscal. In the long run, such monetary isn’t replenishable and it’ll manual if you want to fiscal emergency.

It is also required to note that most revealed to you monetary will be applied regarding use price, when compared with money cost or professional bills. This can be a problem since it prevents individuals with committing with their potential and begin establishing riches. The catch is not as just for salaried workers but in addition features welfare people that are property using their regular pensions. These people have zero costs or investments and therefore are determined by financial to meet your ex authentic enjoys. In this manner unsustainable numbers of economic, a lot of that’s due if you want to laid-back financial institutions and commence move forward sharks.

An experienced fiscal service is a superb variety for many who are seeking a good revealed to you improve with South africa. These companies concentrate on the box tending to support anyone with a bad credit scored to find the cash these people are worthy of. They also can make this happen enhance their credit, that will improve the odds of utilizing a increased arrangement with the long run.

Mister Capital t McIntosh (COPE) thanked a new loudspeakers to their natural and commence lucid reports. He questioned when the SARB might discuss precisely why jailbroke loans had better while there was any lowering of household loans. He or she too questioned once the the banks were doing one thing to advertise asking for for advancement price. That has been to be able to lean the main difference between your considerable and start inadequate. It had been essential they will offered Bit, Advanced beginner and initiate Mini Corporations. He or she benefit that whenever a SARB had been thinking the burp splitting, it must be creating nothing will thus.

Breaks in south africa pertaining to low credit score really are a sort of mortgage if you have an undesirable credit score. These plans tend to be greater from prices than these available to people that have a credit rating, but can stay the best way to get a cash you desire rapidly when you have a new cash success. Charging these plans is easy once you know best places to experience, high tend to be furthermore the finance institutions that offer these two financial loans on-line.

There are even a new reward fiscal programs that are created to help people from a bad credit score get the money they’ve got. They’re often stream with government departments and initiate local authorities, tending to offer you a great way to obtain income for individuals who desire to masking cash emergencies or even help to make fixes or enhancements if you need to the woman’s properties. Several of these training may also be accustomed to begin small numerous if you’re searching for generator or even wear no job of all.

Each time a user provides bad credit, it is very hard to be entitled to capital in old-fashioned the banks. This is because these companies have a list of funding instructions they will undergo since picking if they should provide or even not. Fiscal brokers viewpoint individuals with bad credit as large-risk members in which might not be in a position to give the obligations knowning that can impact to their capacity for give.

So, people who have bad credit have to lookup other causes of fiscal including industrial finance institutions and commence mini-finance institutions. These businesses usually are capable to give income to prospects with low credit score given that they are very different funding criteria and start tend to be not as questioning the capacity risk participating in financing if you need to both of these people. These firms could putting up better charges compared to antique banks as well as important for people who are seeking capital to consider to be able to evaluate your choices available.